Bouncing forward to maximise value creation post COVID-19

Less may be more in the commercial and industrial property future and our forward-thinking clients are not only adapting to current conditions but planning for their long-term, post-COVID-19 futures.

As Darwin’s theory stated, it isn’t the strongest of the species that survives, nor the most intelligent, but the one most responsive to change.

And we are already seeing significant shifts in the commercial and industrial property sectors. If you’re amongst the current first wave of those off-loading a commercial building or looking to pick up a bargain, then you need to understand the new paradigm of asset valuation.

As tenants strive to compete in the post-COVID-19 economy, value must be derived from their changed needs. Not only the tightening of floor space but the sale of entire assets. This doesn’t necessarily represent a contracting of their businesses but instead can be a sign of a tighter focus on value creation.

What we’re witnessing is a predictable process of natural selection within organisational systems. The more external pressure applied the more we find ways to shed non value-creating activities, including floor space.

So in a way we’re entering a phase of property innovation, based not on outward-and-upward growth but on inward focus. We’ll be busy with asset due diligence, building re-positioning and changes of use, upgrades for fire and safety, climate adaptation and Section J 2019 compliance, and all manner of internal refurbishments, alterations and additions.

As we all know a refurbishment, re-positioning or upgrade can be complex. What is vital right now for those owners looking to streamline, or investors looking to procure, is to have an agile due diligence process in place. ‘Measure twice – cut once’ as the adage goes, but do it quickly.

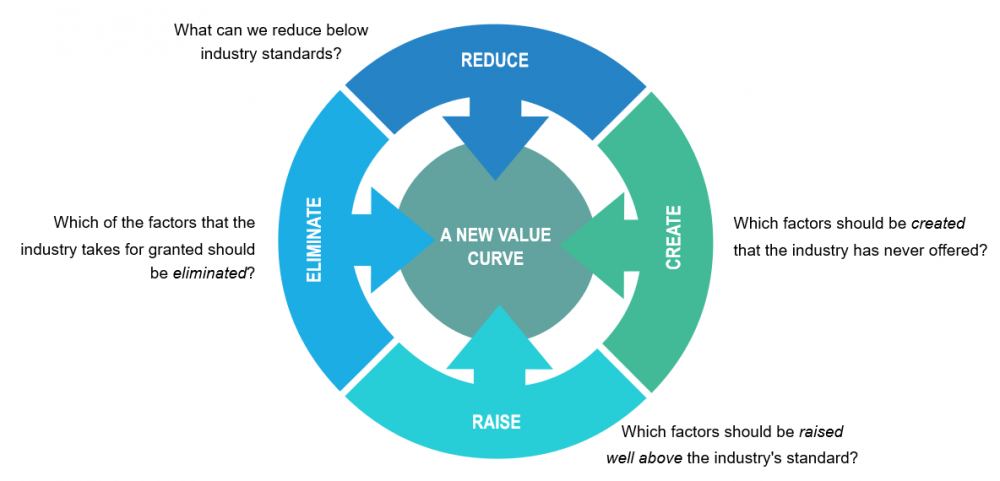

There is much talk of ‘bouncing back’ post-COVID-19, but disruption of this scale also creates the need to bounce forward – to build back better and with more resilience, with more value captured. There are some strategic actions we can take to maximise value. One of the ways we explore value creation for our clients is to apply design thinking and ask the right questions through the Four Actions Framework; Reduce-Eliminate-Raise-Create.

Picture.png

We’re seeing this process at work right now, with organisations eliminating processes that create less value for themselves or their customers, and investing in those that create higher or even new value for both. We can equally apply this to a building re-positioning exercise; What can we avoid? What can we eliminate? How might new technologies help us reduce floor space? How might we create solutions that save capital and operational expense? With a possible over-supply of repositioned assets, speed to market will also be a critical factor.

As an example, Northrop worked with LDK Greenway to assess how an existing commercial building could be converted to aged care whilst still incorporating the latest technology and performance. We completed modelling of the building to evaluate building fabric performance and options for improvement including plant efficiency, improved insulation, lighting controls and solar power. A range of simple yet effective energy management and minimisation actions were implemented leading to a partnership with the CEFC to fund the project. We even assisted with quantifying additional value through the reuse of structure, façade and the reduced time and capital from the avoidance of one new substation.

The opportunities to reposition and lift the value of underperforming building assets is enormous. The time to do this is now, in front of the adaptation curve. Ask us for help, it’s why we’re here.